Massive Debts Loom as Social Security Blunders Lead to $11 Billion Overpayment in 2022!

In a startling disclosure, Senators Gary Peters (D-MI) and Debbie Stabenow (D-MI) have unveiled a staggering $11 billion in Social Security overpayment errors for the fiscal year 2022, thrusting millions of recipients into the quagmire of massive debts.

The senators, alarmed by the deleterious impact on vulnerable beneficiaries, penned a letter urging the Social Security Administration (SSA) to address and rectify the systemic issues perpetuating these errors.

The severity of the crisis was underscored by the senators in their missive to the SSA, emphasizing that these overpayment errors, often taking years to identify, are inflicting financial hardships on seniors and disabled individuals who depend on Social Security benefits.

Recipients, innocently ensnared in administrative mistakes, find themselves burdened with the responsibility of repaying funds they never should have received.

Revealing the magnitude of the problem, the administration acknowledged that over $6 billion is mistakenly disbursed annually, culminating in a record $11 billion in fiscal 2022 alone. The prolonged nature of these errors means that affected recipients may face astronomical debts, ranging from tens to hundreds of thousands of dollars.

Various factors contribute to these overpayment errors, with the senators attributing most to lapses on the part of the SSA. Common errors include miscalculations of a recipient’s benefits or a failure to update the SSA about changes in income. Even when beneficiaries notice discrepancies in their payments, reporting them promptly may not be enough to prevent the unfolding financial catastrophe.

In response to the alarming revelations, the SSA asserted that it handles overpayments on a case-by-case basis, acknowledging the uniqueness of each individual’s situation. The agency encourages beneficiaries to appeal if they disagree with the overpayment assessment or to request a waiver if they believe they should not be held responsible for the funds. Notably, there is no time limit for filing a waiver.

For recipients thrust into the unenviable position of repaying thousands of dollars to the agency, there are several avenues for recourse. Recourse options include appealing the bill, establishing a repayment plan, or even resorting to declaring bankruptcy as a last resort.

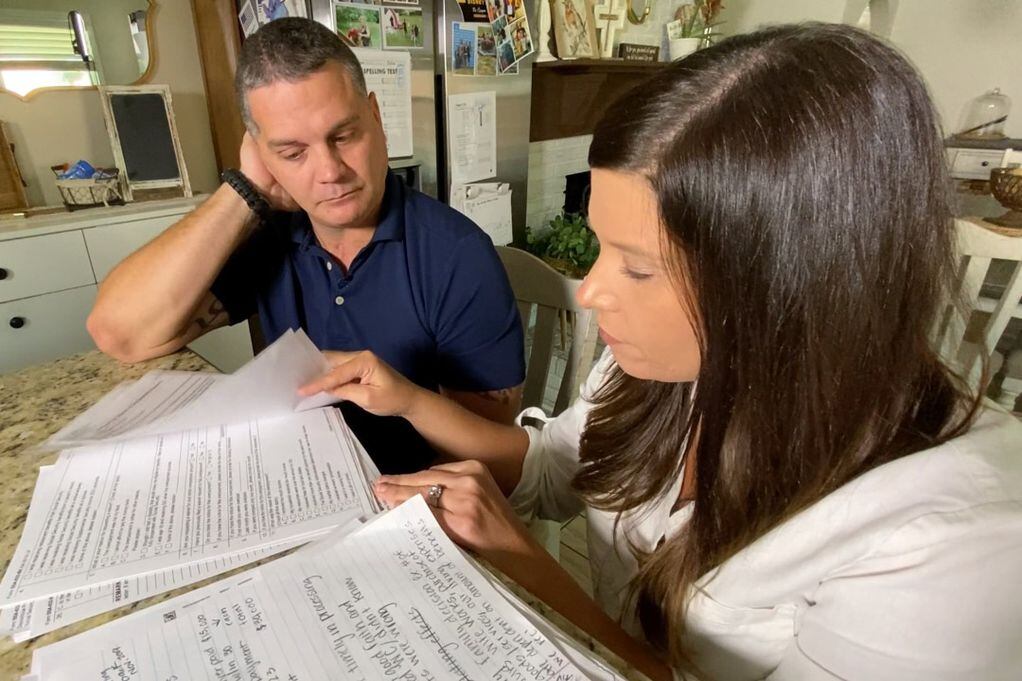

The senators’ letter underscores the human toll of these overpayment errors, citing numerous Michiganders who have shared stories of unexpected overpayments causing profound distress. The article delves into the personal narratives, providing a poignant perspective on the real-life impact of administrative shortcomings.

Related News:

- Social Security Under Fire: Seniors Hit with Unexpected Bills Spark Urgent Calls for Change!

- Senate Delays Decision on Virginia College Sports Betting Bill Until 2025

- Struggling Seniors: Social Security Boost Puts Oxygen Machines at Risk

In their letter, Sens. Peters and Stabenow emphasize the urgency of reform within the SSA, urging the administration to improve processes and controls to curtail the frequency of overpayment errors. The article analyzes the proposed reforms and their potential implications for safeguarding beneficiaries against future financial crises.